how to calculate nj taxable wages

Your average tax rate is 1060 and your marginal tax. Using our New Jersey Salary Tax Calculator.

New Jersey Nj Tax Rate H R Block

The best payroll software tools that calculate taxable wages for you.

. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages. New Jersey income tax rate.

Opry Mills Breakfast Restaurants. New Jersey Tax Rate 2017 Nj Employment Payroll Taxes Pay Stub Templates 10 Free Printable Word Excel Pdf. Census Bureau Number of cities with local income taxes.

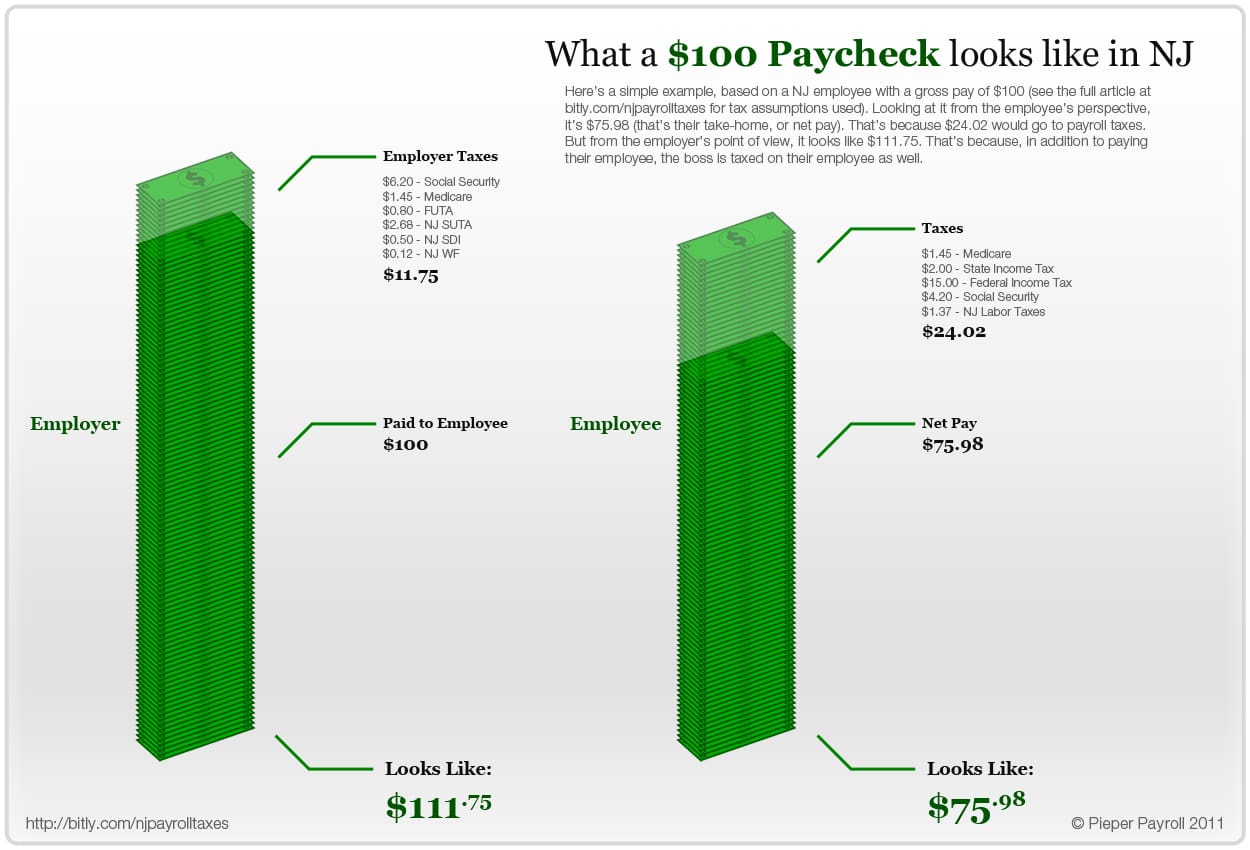

New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Incredibly a lot of people fail to allow for the income tax deductions when completing. NJ-WT New Jersey Income Tax Withholding Instructions This Guide.

This graduated tax is levied on gross income earned or received after June 30 1976 by New Jersey resident and nonresident individuals. Taxable Income in New Jersey is calculated by subtracting your tax deductions from your gross income. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee.

Restaurants In Matthews Nc That Deliver. Just enter the wages tax withholdings. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The most they can contribute for 2019 is 5848. Filing 20000000 of earnings will result in 1047130 of your earnings. There are two main types of wages.

Filing 20000000 of earnings will result in 1175360 being taxed for FICA purposes. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. If you make 61500 a year living in the region of New Jersey USA you will be taxed 10371.

New Jersey Paycheck Quick Facts. You must report all payments whether in. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Your average tax rate is 1198 and your marginal tax rate is 22. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. This marginal tax rate means that.

Taxable Retirement Income. New Jersey Income Tax Calculator 2021. As of January 1 2020 workers contribute 026 of the first 134900 earned during the calendar year.

O You can exclude from New. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from. - New Jersey State Tax.

How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and. Figure out your filing status. How to calculate nj taxable wages Friday June 10 2022 Edit.

Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio. Press Calculate to see your New Jersey tax and take home breakdown including Federal Tax deductions. The Unemployment Trust Fund reserve ratio is calculated as follows.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey. How To Calculate Nj Taxable Wages. Work out your adjusted gross income Total.

2021 New Jersey Payroll Tax Rates Abacus Payroll

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Pin On Templates Free Download

2019 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

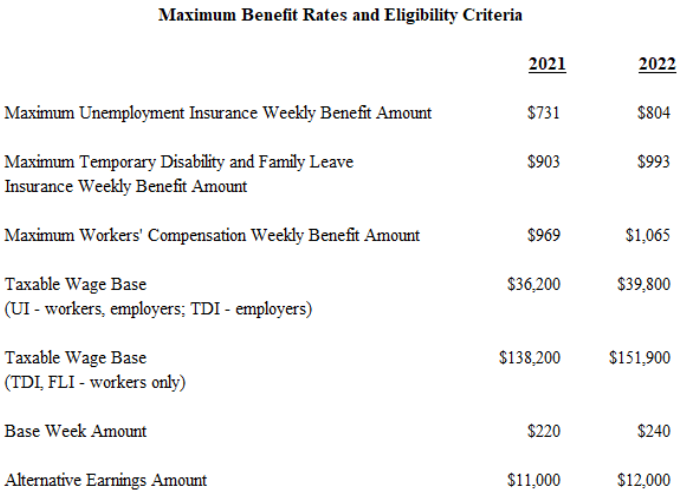

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Aatrix Nj Wage And Tax Formats

New Jersey Nj Tax Rate H R Block

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Nj Labor Department Max Benefit Rates Increased On Jan 1 Wrnj Radio

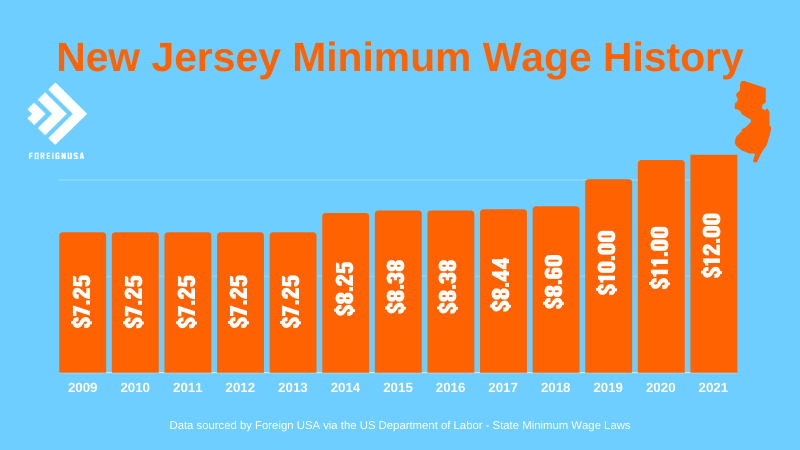

Minimum Wage In New Jersey New Jersey Minimum Wage 2022

2020 New Jersey Payroll Tax Rates Abacus Payroll

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

Aatrix Nj Wage And Tax Formats

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Services Provided By New Jersey Payroll Services Llc Templates Sample Resume Resume Template Free